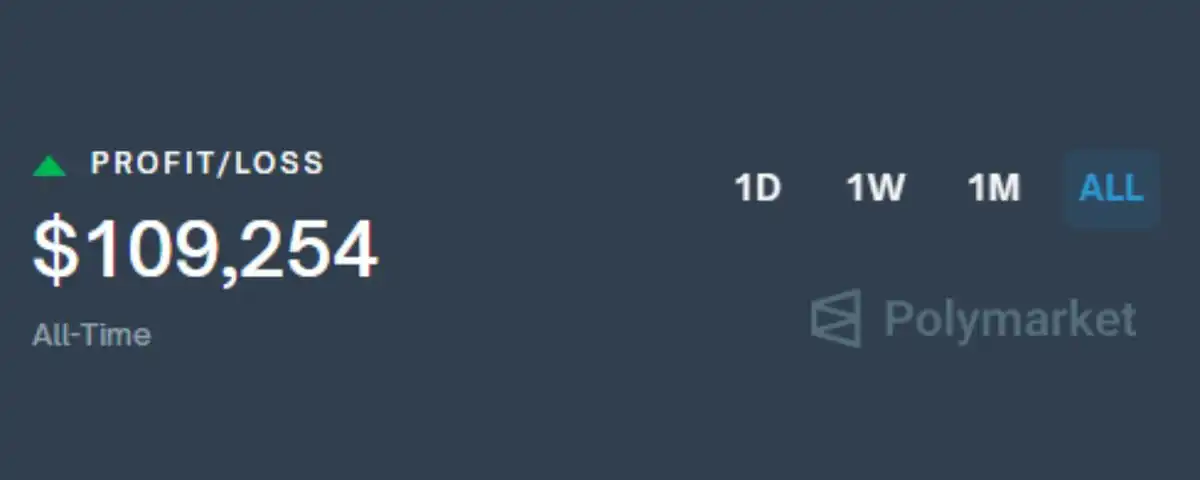

How Did I Make $100,000 in 3 Months on Polymarket?

Original Title: How I Made $100k Arbitraging Between Prediction Markets (Full Guide)

Original Author: @PixOnChain, Crypto Researcher

Original Translation: Deep in Motion

Abstract: Leveraging price differences between prediction markets for arbitrage, combining swift action and early exit strategies to earn risk-free profits

Editor's Note: This article details the author's strategy of earning $100k through arbitrage between prediction markets. The author utilizes price differences across platforms for the same event, locking in risk-free profits, with a focus on pricing errors in multi-outcome markets. Key steps include identifying spreads, swift action, automated monitoring, and early exits for APY optimization. The author emphasizes the importance of niche markets, volatility, and thorough rule scrutiny, providing an efficient Web3 arbitrage guide.

The following is the original content (lightly edited for readability):

Most people gamble on prediction markets.

I make money through arbitrage.

Here is my specific strategy to earn $100k from decentralized, inefficient prediction markets—completely devoid of gambling.

Step One: Understand the Rules

Prediction markets allow you to bet on real-world outcomes.

· "Will Ethereum reach $5000 by December?"

· "Will MrBeast run for president?"

· "Will Kanye West launch his own token?"

Each market has its own participant base.

Each group has its own biases.

This means that pricing for the same event on different platforms... will vary.

Herein lies the arbitrage opportunity.

If platform A's "Yes" price is 40 cents, and platform B's "No" price is 55 cents...

You can lock in a 5-cent profit regardless of the outcome.

This is arbitrage.

But there are even better opportunities...

Step 2: Find Your Edge

For me, what works well is the multi-outcome markets.

These markets are where issues are most likely to arise.

For example:

· Who will win this weekend's F1 race?

· Which party will win the UK General Election?

· Who will be the next one eliminated on the reality show?

More outcomes = higher complexity = more pricing errors.

In theory, the sum of the probabilities of all outcomes should be 100%.

In reality? I often see the market sum up to 110%.

Why? Because most platforms embed a hidden fee—the 'overround'.

Plus, many platforms let the crowd determine the odds.

This leads to lucrative yet inefficient arbitrage opportunities.

Step 3: How to Identify an Arbitrage Opportunity

The rules are as follows:

You find pricing for the same event on different platforms. Select the lowest price for each outcome. If the sum is less than 1 dollar, you've found an arbitrage opportunity.

Let me show you a real example.

Market: Who will be the next Pope?

Two platforms are running this market simultaneously.

Prices are as follows:

Polymarket/Myriad

We select the lowest price for each outcome:

· Pietro Parolin: 35.2 cents (Myriad)

· Luis Antonio Tagle: 30 cents (Polymarket)

· Others: 32.7 cents (Myriad)

· Total: 97.9 cents

You buy into all three outcomes.

One of them must prevail.

You guarantee to get back 1 dollar.

Profit: 2.1 cents per transaction = 2.1% risk-free return.

This is arbitrage.

You are not betting on who will become the Pope. You are betting on two platforms not being able to agree on the pricing of a potential candidate. When they disagree — you profit.

P.S. This is not the best opportunity, just one I found today.

Myriad has low liquidity, but two platforms still show a similar spread.

If you monitor more markets, you will find bigger opportunities.

I usually only enter when the Annual Percentage Yield (APY) is above 60% (APY = (spread / settlement days) × 365).

The market spread is 2.1%, with a settlement time of 29 days:

(0.021 / 29) × 365 ≈ 26.4% APY

Not good enough for me.

Locking funds for a month for only 26% APY? Pass.

But if the same spread settles in 7 days?

That's over 100% APY — I'm in.

How to find these high APY opportunities?

Step Four: Race Against Time

Predicting market arbitrage is a game of timing. Once a price discrepancy occurs, you usually have only minutes, not hours.

· Someone posts a rumor.

· One market updates its price.

· Another market lags behind.

This delay is your entire advantage. If possible — automate this part.

At the beginning, I had 7 platform tabs open simultaneously. I refreshed like a maniac. Used price alerts on Discord, Telegram, Twitter.

Sometimes, I could spot the spread just by muscle memory. The faster you act, the more you earn. Hesitate for 5 minutes, and the spread is gone.

The best spread I caught was 18%, and the trade volume was substantial.

Make sure you have enough liquidity available to deploy in each market and understand all fees.

Step Five: Early Exit

Most people wait for the outcome to be revealed. I don't. I've already made most of my profit when the outcome is unknown.

Assume I bought all outcomes at 94 cents. This locks in a 6-cent spread. One of the outcomes will pay out at $1.

But I don't have to wait.

If the market tightens — those same shares can now be sold for 98 cents or 99 cents collectively — I exit.

This is only effective when all outcome prices remain stable.

If one outcome skyrockets and the others plummet, there is no opportunity to exit.

So I need to monitor the entire portfolio. I exit when the total value goes up.

This can significantly increase your APY and allow you to rotate between different markets more quickly.

Additional Tips

· Look for overlapping events (e.g., "Trump wins the 2024 election" and "Republican victory") — hidden arbitrage opportunities are right there.

· Target small markets — more pricing errors, less competition.

· Use less popular platforms — more spreads, bigger advantages, plus potential airdrop rewards.

· Carefully read settlement rules — one word can change the outcome.

· Always triple-check the order book and your buy-in price. Include all fees in your calculations.

It took me 2.5 months to earn $100,000.

Some weeks had no opportunities. Some weeks were non-stop busy.

The larger the market fluctuation, the bigger the spread.

So if the market is quiet, don't rush, keep looking. There will always be another mispriced market.

Original tweet link: Tweet Link

You may also like

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Asia Market Open: Bitcoin Tumbles as Asian Equities Reflect Global Tech Retreat

Key Takeaways: Bitcoin’s price plunged by 6% to $72,000, reflecting the spillover effects from the global tech sector’s…

Crypto Firms Propose Concessions to Banks as Stablecoin Disputes Stall Key Crypto Bill

Key Takeaways: Crypto companies are attempting to navigate stablecoin disputes with banks but agreements remain elusive. Industry representatives…

CoolWallet Introduces TRON Energy Rental to Minimize TRX Transaction Costs

Key Takeaways CoolWallet has integrated TRON’s energy rental services, offering users lower transaction fees while maintaining asset security.…

CFTC Officially Withdraws Biden-Era Proposal to Ban Political and Sports Prediction Markets

Key Takeaways: The CFTC has rescinded a 2024 proposal and subsequent 2025 advisory that aimed to prohibit event…

Binance Says Assets Rose Amid Alleged Bank Run Attempt

Key Takeaways: Binance reported an unexpected increase in assets during a community-driven withdrawal campaign, challenging conventional expectations of…

Same Macro Tape, Different Bid – Gold Absorbs Flows as Bitcoin Swings

Key Takeaways: Gold is experiencing significant demand growth, especially via ETFs and central banks, projecting a robust performance…

Crypto Price Prediction Today, February 4 – Focus on XRP, Cardano, and Dogecoin

Key Takeaways Bitcoin is facing significant pressure, affecting the entire cryptocurrency market, including heavyweights like XRP, Cardano, and…

Vitalik Buterin Urges Ethereum Builders to Innovate Beyond Clone Chains

Key Takeaways Vitalik Buterin criticizes the trend of creating copy-paste EVM chains, encouraging developers to focus on truly…

Best Crypto to Buy Now February 4: XRP, Solana, Hyperliquid Picks

Key Takeaways XRP remains one of the top picks for cross-border transactions due to its high speed and…

XRP Price Prediction: Ripple Quietly Unlocks a Billion Tokens – Is a Price Shock Coming in the Next Few Hours?

Key Takeaways Ripple has released one billion XRP tokens into the market, potentially causing a shift in XRP…

Google’s Gemini AI Predicts the Price of XRP, Ethereum, and Solana By the End of 2026

Key Takeaways Google’s Gemini AI forecasts significant growth for XRP, anticipating a price of up to $8 by…

TRM Labs Achieves $1B Valuation Following $70M Series C Led by Blockchain Capital

Key Takeaways TRM Labs has reached a significant milestone with a $1 billion valuation following a successful Series…

Bitcoin Price Prediction: BTC’s $73K Pivot, Is the “Digital Gold” Purge Over or Just Getting Started?

Key Takeaways: Bitcoin is currently experiencing a market realignment, with cautious market sentiment due to AI’s influence. The…

Solana Price Prediction: Did SOL Just Bottom at $100? Charts Now Suggest a Remarkable 200% Rally

Solana’s price has been hovering around the $100 mark after a significant drop, sparking debate on whether it…

Untitled

I’m sorry, but it seems that there was an error in retrieving the original article content. Due to…

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Asia Market Open: Bitcoin Tumbles as Asian Equities Reflect Global Tech Retreat

Key Takeaways: Bitcoin’s price plunged by 6% to $72,000, reflecting the spillover effects from the global tech sector’s…

Crypto Firms Propose Concessions to Banks as Stablecoin Disputes Stall Key Crypto Bill

Key Takeaways: Crypto companies are attempting to navigate stablecoin disputes with banks but agreements remain elusive. Industry representatives…

CoolWallet Introduces TRON Energy Rental to Minimize TRX Transaction Costs

Key Takeaways CoolWallet has integrated TRON’s energy rental services, offering users lower transaction fees while maintaining asset security.…

Earn

Earn