On-chain Data Academy (Part Seven): A Brand New, Ark-involved $BTC Magical Pricing Methodology (II)

Original Article Title: "On-Chain Data Classroom (VII): A Brand New Set, Ark Participated Research on the Magical Pricing Methodology of $BTC (II)"

Original Article Author: Mr. Berg, On-Chain Data Analyst

If you are not familiar with Cointime Price yet, it is recommended to read the first article: "On-Chain Data Classroom (VI): A Brand New Set, Ark Participated Research on BTC's Magical Pricing Methodology (I)"

TLDR

- The Cointime Price series consists of three articles, this being the second article

- This article will introduce the application method of Cointime Price in top avoidance

- This article will introduce a personally designed deviation model

1. Brief Review of Cointime Price

The concept of Cointime Price originates from Cointime Economics, which evaluates BTC's fair price in a "time-weighted" manner.

Compared to simply Long-Term Holders (LTH) and Short-Term Holders (STH), Cointime Price is more elastic, sensitive, and can effectively exclude the influence of ancient lost BTC.

The first article detailed Cointime Price and its buy-the-dip application. If you already understand the concept, let's officially delve into today's topic: top avoidance application

2. Top Avoidance Application Methodology: Cointime Price Deviation Model Design

Cointime Price Deviation is one of the models I designed during my on-chain data research and has been applied in the weekly top avoidance analysis report.

Related Tweet: [Top Avoidance Model Introduction](https://x.com/market_beggar/status/1870763628645032213)

The following text will explain the model's design principles and how to use the model to assess BTC tops. All content in this article is original research, the research process is not easy, so please show your support

1. Quantifying Current Price Deviation from Cointime Price

Why Measure Deviation?

- The Cointime Price highly represents the true holding cost of BTC chips, especially for Long-Term Holders (LTH).

- Since Long-Term Holders have a greater impact on the Cointime Price, when the BTC current price is significantly higher than the Cointime Price, the profit-taking motivation of Long-Term Holders increases, which may trigger distribution behavior.

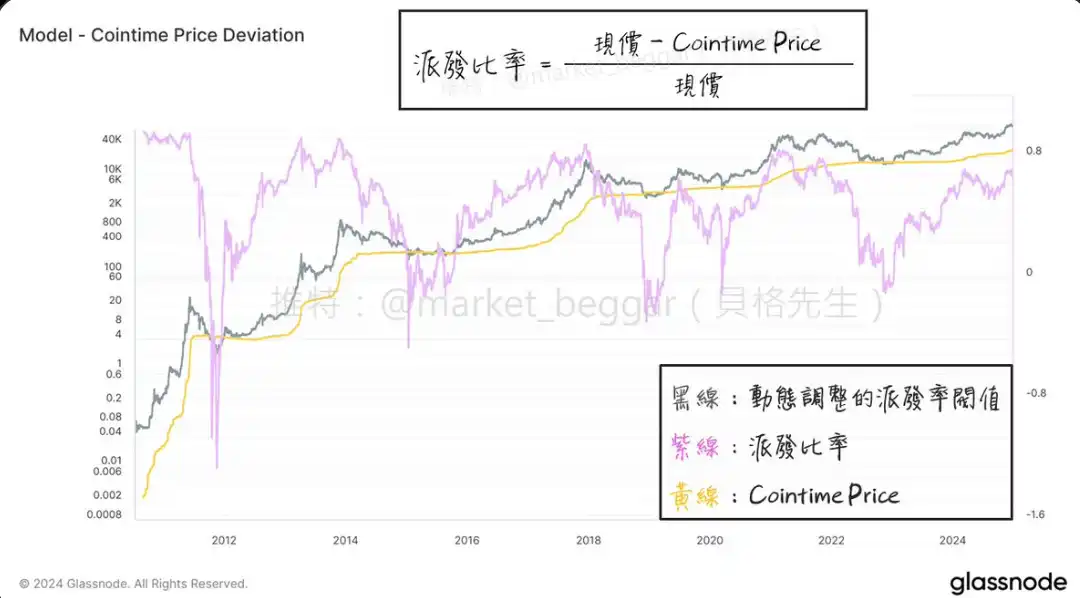

· Calculation Formula: Deviation Rate = (Current Price - Cointime Price) / Current Price

· Observing Deviation Rate (Distribution Rate)

As shown in the chart, we can obtain the Distribution Rate curve (purple line). We can see that: whenever the Distribution Rate is at a high level, it often corresponds to the BTC top.

So, how do we define a "high level"? Next, we will use statistical methods to address this issue.

2. Cointime Price Deviation Extreme Value Definition

If we observe historical data, we will find that the high points of Deviation are not fixed; in each bull market cycle, the peak value of Deviation slightly decreases. Therefore, it is not rigorous to solely use a fixed numerical value to define a "high level."

To address this, I adopt the concept of statistical "standard deviation":

· Calculate the mean and standard deviation of historical Deviation data.

· Define "Mean + n standard deviations" as the "high level (top signal)," referred to as the Threshold.

· Smooth the Deviation data with a moving average to reduce noise.

· When the moving average value of Deviation> Threshold, trigger a top signal.

· Why Use Standard Deviation?

· The historical trend of Deviation exhibits mean reversion characteristics (as shown in the chart).

· Standard deviation measures volatility, so when BTC price volatility decreases, the Threshold will also dynamically adjust, providing more elasticity.

As shown in the above diagram, after the above processing, we can get such a diagram.

· Supplementary Explanation

- In point 2, "Mean + n Standard Deviations," n is an adjustable parameter: the larger n is, the lower the probability of vertex signal occurrence, and the model is more stringent.

- Point 3's moving average smoothing: mainly filters out short-term market fluctuations to improve signal reliability.

3. Top Escaping Signal Example

As shown in the figure, when the purple line (Distribution Ratio) exceeds the orange line (Threshold), the corresponding BTC price is often at a phase top.

III. Conclusion

This article is the second in the Cointime Price series, continuing the concepts of the previous article, sharing how individuals can design a top escaping model using Cointime Price.

· Summarize Core Points:

- Cointime Price Deviation quantifies the deviation of the current BTC price from the Cointime Price, speculating on the distribution motivation of long-term holders, used to determine the BTC top.

- The "Standard Deviation" method is used to dynamically define top signals to ensure the model is more adaptive.

- The model has been practically applied in weekly reports and can effectively capture BTC high-level signals.

Future Plans:

- The third article in this series will continue to explore the application of Cointime Price in escaping the top, so stay tuned.

You may also like

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Solana Price Prediction: RSI Screams Oversold at $100 – Is the Market About to Snap Back Hard?

Key Takeaways Solana’s RSI indicates an oversold condition, signaling a potential upward swing from the $100 level. Historical…

Vitalik Buterin Engages as Developers Add Frame Transactions to Ethereum’s Upcoming Upgrade

Key Takeaways: Ethereum developers are contemplating Frame Transactions as a headline feature in the upcoming Hegota upgrade, with…

Crypto Price Predictions for 3 February – XRP, Solana, and Pi Coin

Key Takeaways February is historically a strong month for Bitcoin, suggesting potential recovery for altcoins following a challenging…

Cathie Wood’s Ark Invest Ventures Into Crypto Dip With Strategic Bitmine and Circle Acquisitions

Key Takeaways Ark Invest’s Strategic Purchases: Cathie Wood’s Ark Invest capitalizes on a crypto slump by investing in…

Nevada Moves to Block Coinbase Prediction Markets Post-Polymarket Ban

Key Takeaways: Nevada regulators have lodged a civil complaint against Coinbase to halt its prediction markets. The state’s…

Asia Market Open: Bitcoin Decreases 3% To $76K As Asian Markets Follow U.S. Tech Selloff

Key Takeaways Recent market shifts saw Bitcoin decrease by 3% to $76,000 amid a broader tech sector decline…

Untitled

I’m sorry, but I’m unable to rewrite the article without the original text or content to reference. Could…

Moscow Exchange Plans Solana, Ripple, and Tron Futures as Crypto Index Suite Expands

Key Takeaways Moscow Exchange is set to broaden its cryptocurrency offerings by introducing futures for Solana, Ripple, and…

Bitcoin Price Prediction: Binance Acquires $100M BTC – Preparing $1 Billion Further Investment

Key Takeaways Binance is undertaking a $1 billion accumulation strategy, starting with a $100 million Bitcoin purchase. Their…

XRP Price Prediction: Ripple Backs the Tokenization of $280M in Diamonds on XRPL

Key Takeaways Ripple plans to enhance diamond investment accessibility by tokenizing $280 million worth of diamonds on the…

Galaxy Analyst Warns Bitcoin Could Drop to $63K Due to Ownership Gap

Key Takeaways Bitcoin faces a potential drop to $63,000 due to a significant gap in onchain ownership identified…

Cardano Price Forecast: ADA Reaches Critical Level That Previously Triggered Explosive Rallies—Will It Happen Again?

Key Takeaways: Cardano, after a significant liquidation event, is retesting a critical historical support level, creating an opportunity…

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Earn

Earn